Solution: Clean Water Discussion

1. The Base Case

The Excel file Clean Water Financial Plan contains a detailed solution of the management case. Let's look at some of the main takeaways.

Cash flow projections

- The operating business is projected to be fairly stable and very profitable. This is consistent with the firm's past. For example, in Year 2, the projections imply an EBIT of roughly 700'000. Given projected net revenues of roughly 3.4 million, this corresponds to a healthy EBIT margin of 20%.

- The exception is Year 1, where extraordinary restructuring charges lead to substantially lower profitability.

- Given the low capital intensity of the business, investment outlays are moderate. Therefore, the firm's free cash flows are also very stable and rather attractive. Looking at year 2, the numbers imply that for every EUR of net revenues, the firm generates a free cash flow of 16 cents.

- The following table summarizes the firm's operating and investment cash flows and derives the projected free cash flows:

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

EBIT

318

698

722

757

804

861

871

880

890

- Adjusted taxes

67

147

152

159

169

181

183

185

187

NOPLAT

251

551

570

598

635

680

688

695

703

+ Depreciation

80

78

76

76

75

75

75

75

75

- Increase op. assets

-18

9

17

26

34

43

7

7

7

+ Increase op. liabilities

-87

4

8

11

15

19

3

3

3

Operating cash flow

262

624

637

659

691

731

759

766

774

- Net investments

100

75

75

75

75

75

75

75

75

Free cash flow

162

549

562

584

616

656

684

691

699

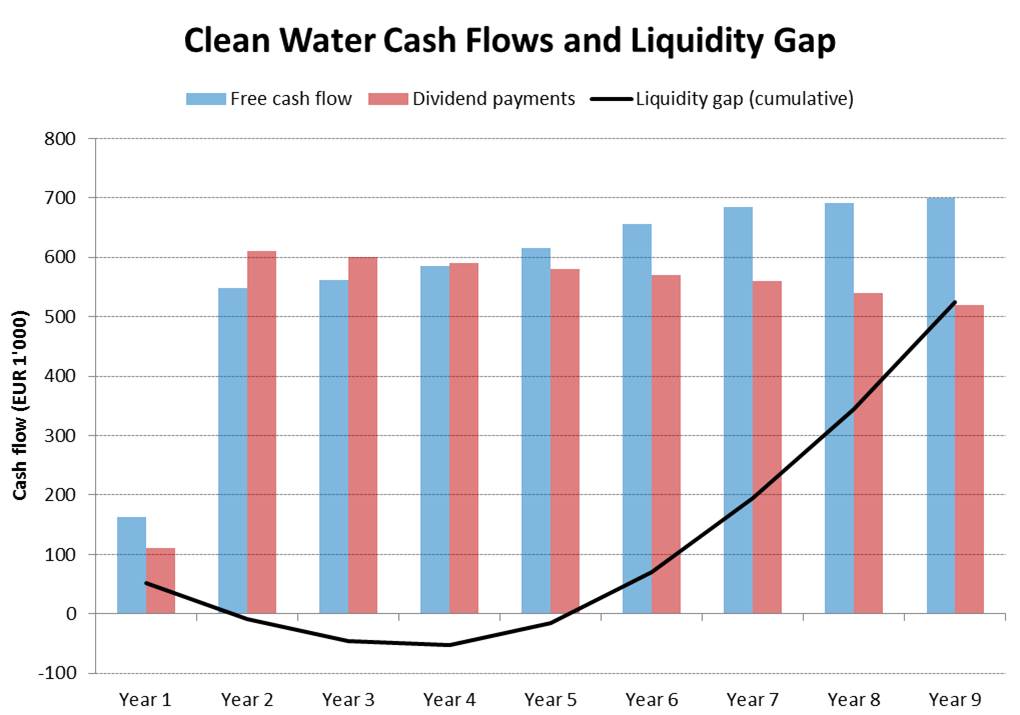

The buyer's cash needs

- Remember from before that the buyer will need substantial dividend payments from Clean Water to service the debt he has assumed to finance the purchase price. The question is whether the cash flows from the previous table will cover these cash needs. The answer is "not quite." The following table shows the debt payments the buyer will have to make (see the case intro for details):

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Total debt payments

110

610

600

590

580

570

560

540

520

- Interpretation:

- In Year 1, the firm is expected to generate a FCF of 162. The dividend requirements are 110. Hence, the firm should be able to pay the dividend and retain 52 [=162 - 110] as excess cash for future dividend payments.

- In Year 2, the FCF is 549 and the dividend is 610. Hence, the dividend exceeds the FCF by 61 [= 610 - 549]. Part of this liquidity gap can be bridged with the excess cash (52) from Year 1. To cover the remaining liquidity gap of 9 [=61 - 52], Clean Water will need to draw on its Revolving credit line. So the sources of funds for the dividend payment of 610 in Year 2 are:

- Free cash flow: 549

- Excess cash: 52

- Revolving credit: 9

- We proceed accordingly for the following years.

- The following table summarizes the full cash flow statement of Clean Water:

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

EBIT

318

698

722

757

804

861

871

880

890

- Adjusted Taxes

67

147

152

159

169

181

183

185

187

NOPLAT

251

551

570

598

635

680

688

695

703

+ Depreciation

80

78

76

76

75

75

75

75

75

- Increase op. assets

-18

9

17

26

34

43

7

7

7

+ Increase op. liabilities

-87

4

8

11

15

19

3

3

3

Operating cash flow

262

624

637

659

691

731

759

766

774

- Investments

100

75

75

75

75

75

75

75

75

Free cash flow

162

549

562

584

616

656

684

691

699

- Interest exp. (after taxes)

0

0

0.4

2

3

1

0

0

0

- Repayment Revolver loan

0

0

9

47

55

22

0

0

0

+ New Revolver loan

0

9

47

55

22

0

0

0

0

Residual cash flow

162

558

600

590

580

634

684

691

699

+ New equity

0

0

0

0

0

0

0

0

0

- Net dividend

110

610

600

590

580

570

560

540

520

Change in cash

52

-52

0

0

0

64

124

151

179

- As we can see, the firm will just be able to meet the owner's cash requirements. To do so, however, it will have to draw on its credit line.

- Given a credit line of 100'000, the numbers also show that there is very little margin of error. According to the financial plan, Clean Water will need to use 55'000 of that credit line in order ot survive. So the proposed financing structure really goes to the firm's limits.

- The following figure illustrates this graphically.

Next steps

Given that the proposed financing structure goes to the limits of what the business can support, the logical next step is to revisit some of the key assumptions. Are these assumptions realistic? How likely is it that the firm will be able to exceed the projections? What happens if it misses the projected values?

Let's look at two of the many additional analysis that one might want to conduct in such a situation: A zero-growth scenario and a scenario with less favorable revenue margins.